Cowboy Ventures’ Aileen Fisher (whose team has the world’s best headshots) coined the term “unicorn” in 2013 to describe VC-backed companies valued in private or public markets at $1 billion+.

Fast-forward to today and we can learn a lot about the future of venture capital.

In 2013, there were a mere 39 venture-backed companies valued at over $1 billion. They accounted for only .07% percent of startups. This then-astonishing number seems quaint now. In 2013, the 39 unicorns accounted for only 0.4% of US GDP. Today, there are 1,484 unicorns – a 3,600% increase, collectively worth $5 trillion and accounting for 10% of US total GDP. During the most overheated stretch from Q1 2021 to Q1 2022, 650 unicorns were minted in just five quarters. That’s 100+ per quarter.

What drove the fall?

One word: Plastic. No, wait, different word: Demand.

In 2013, there were 850 active venture funds. Today there are 2,500. And it wasn’t just the number of funds that grew explosively: fund size grew explosively too.

A $400 million venture capital fund? How provincial. a16z is raising a $3.4 billion fund – and that won’t even be its largest. Greylock just announced a $1 billion fund; Venom raised a $1 billion fund last year. And Sam Altman is making them all look like pikers: he’s raising $7 trillion.

That drove huge demand for deals, which pushed valuations higher. And as mega funds grew, they needed mega exits.

Venture funds typically drive returns from their stakes in just a few companies. Mega funds require ever-larger exits from their winners to deliver acceptable returns. For example, to return just the initial capital of a modest-sized $400 million fund, a fund might need to own 20% of two different $1 billion companies, or 20% of a $2 billion company.

That created perverse incentives for venture funds to push their holdings too far, too fast, to achieve unicorn status. As we’ve written previously, that led to major hangovers when the champagne stopped flowing and companies went public last year in “down round IPOs.” Turns out, the math isn’t mathing.

What drove the rise?

One word: Demand.

Mega rounds worth $100mm+ cratered. In 2021, mega rounds were on fire, with 350+ closing each quarter. In Q4 2023, that fell to just 78 — the lowest level since 2017.

A big driver was crossover investors fleeing – their deal count fell to the lowest level since 2017. Tiger Global and SoftBank alone backed over 500+ just in 2021. In only 2023, they did less than one-tenth of that, backing 46 deals.

As capital fled, the unicorn population collapsed.

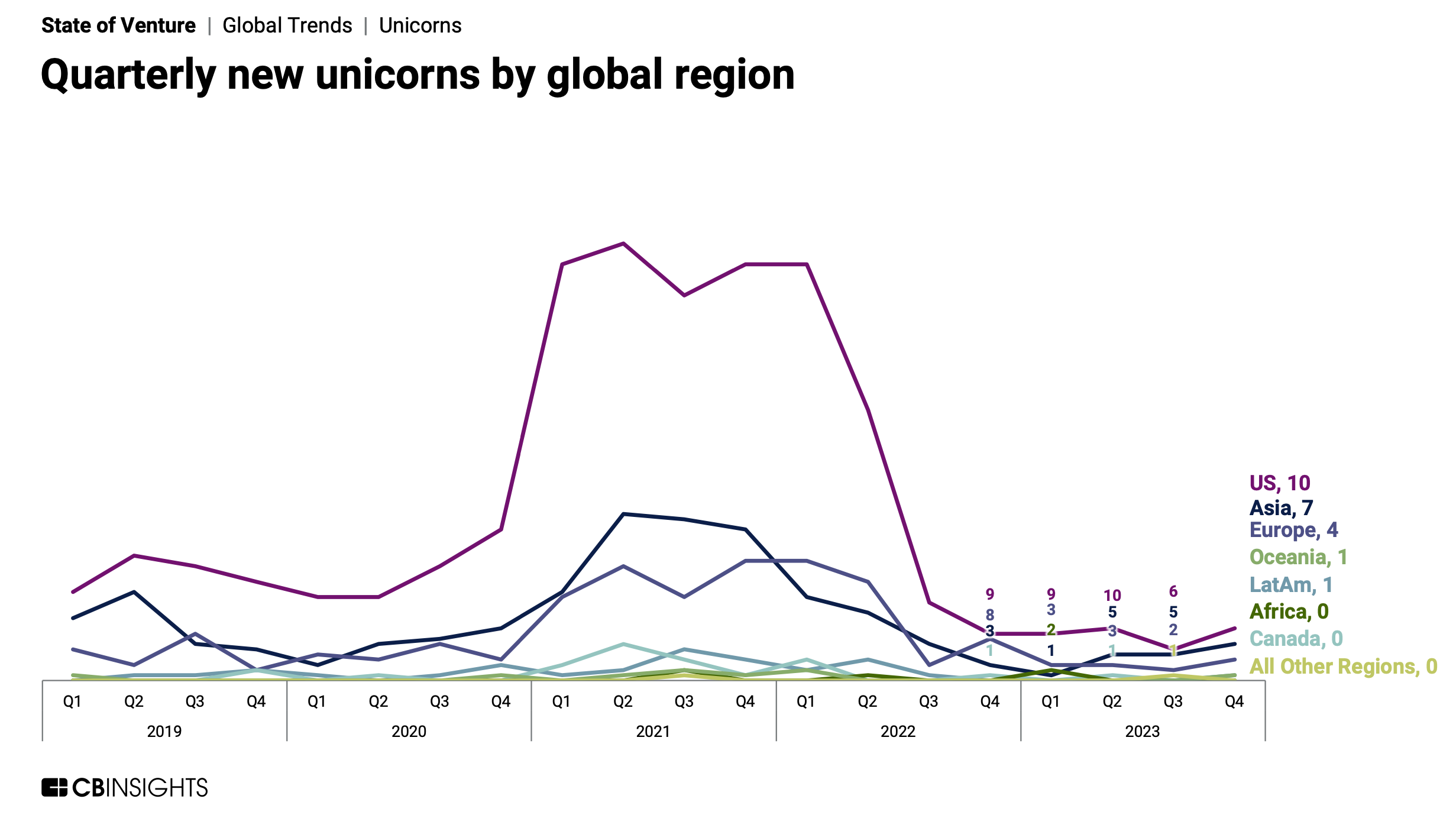

As capital fled, the unicorn population collapsed. Just 12 unicorns were created in the third quarter of 2023, the lowest quarterly level since 2016.

Were unicorns ever real? Papercorns and Zirpicorns.

Some were. But many were mythical creatures: 40% of unicorns are trading below a billion dollar valuation in secondary markets. And exits remain very uncommon – unicorns are going public at a much slower rate than they are being created. Today, 93% are “papercorns” – companies that are privately valued as unicorns, but which haven’t exited. (In 2013, that number was 36%.)

And in a further warning signal, 60% of unicorns today are “ZIRPicorns” – last valued between January 2020 and March 2022, when private multiples were at historic highs and interest rates were near zero. As those companies reprice, many more unicorns are likely to fall out of the dataset. (And lose their horns.)

What needs to change for the future of VC?

First, capital efficiency is lousy right now. It needs to get better. Much better. This measures current valuation divided by private capital raised. In 2013 when “unicorn” was coined, that number was 26x. Today, it’s 7x. And some 2023 unicorns are currently worth less than 2x capital raised.

Second, the venture ecosystem needs to continue to rightsize. Some VCs will retire, some will raise smaller funds, some will downsize their teams, some will fold.

Third, megafunds need to become less mega. The pressure to deliver multibillion dollar outcomes has created incentives to push valuations too high. When sanity is restored as often happens when these private companies go public, companies that were pushed too far and too fast into nosebleed valuations, have a painful reckoning with reality.

Fourth, funds will need to go back to basics of backing earlier stage companies, rather than piling into an F round and hoping for a giant pop at IPO. That’s already happening: In 2023, the share of venture investments that were early-stage, hit a high of 65%.

Should we all climb out on a ledge?

One word: No.

Despite the painful reckoning, very strong tailwinds remain. As Aileen Fisher noted, “the growth and spread of tech companies is akin to living through a next Industrial Revolution, powered by software.”

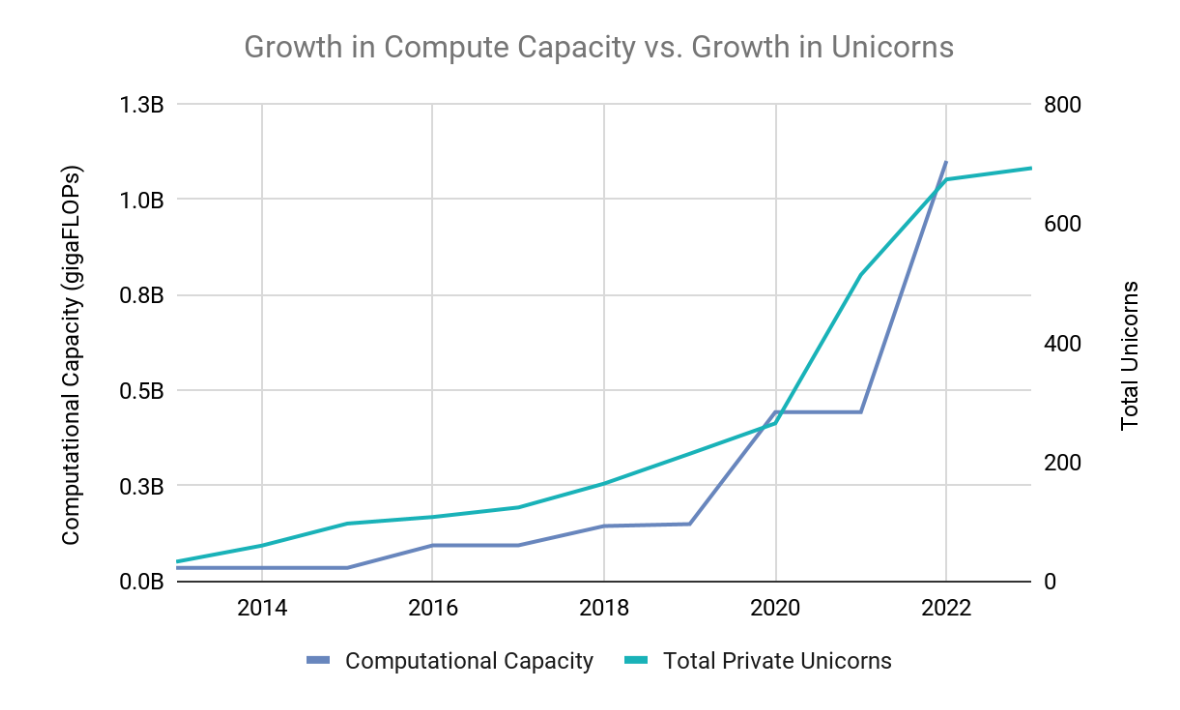

In fact, Cowboy Ventures posits that a “Software Unicorn Power Law” which correlates to compute growth, suggests that there could be 1,400+ unicorns created in 2033 alone – matching the total unicorn population today.

Giddy up.